We all know that the weather patterns are changing, so having defensive strategies like flood insurance in place is often a logical move when protecting Australian assets. However, many property owners have concerns over the associated price tag of flood insurance, plus questions surrounding how their risk is calculated and what data is being used to determine their risk level.

In this blog, we’ll bring you up to speed on everything related to flood insurance to help you make informed decisions on securing your property against floods.

What is flood insurance?

Think of flood insurance as a safety net to help overcome damage caused by water overflow on what is typically dry land. This water overflow can be from any natural watercourses such as lakes, rivers and creeks. It can also be from man-made bodies of water, such as canals, reservoirs and dams.

Some key pointers: flood cover doesn’t automatically guard against oceanic events (like high tides or storm surges) or rising sea levels. It is also worth confirming if you are covered for water damage caused by rain falling from the sky (i.e. roof and ceiling damage, or minor ponding around your front door during a storm for example), which is typically covered under storm cover. As with any insurance, it’s important to read the fine print in the Product Disclosure Statement when it comes to your own situation.

How is my flood risk determined?

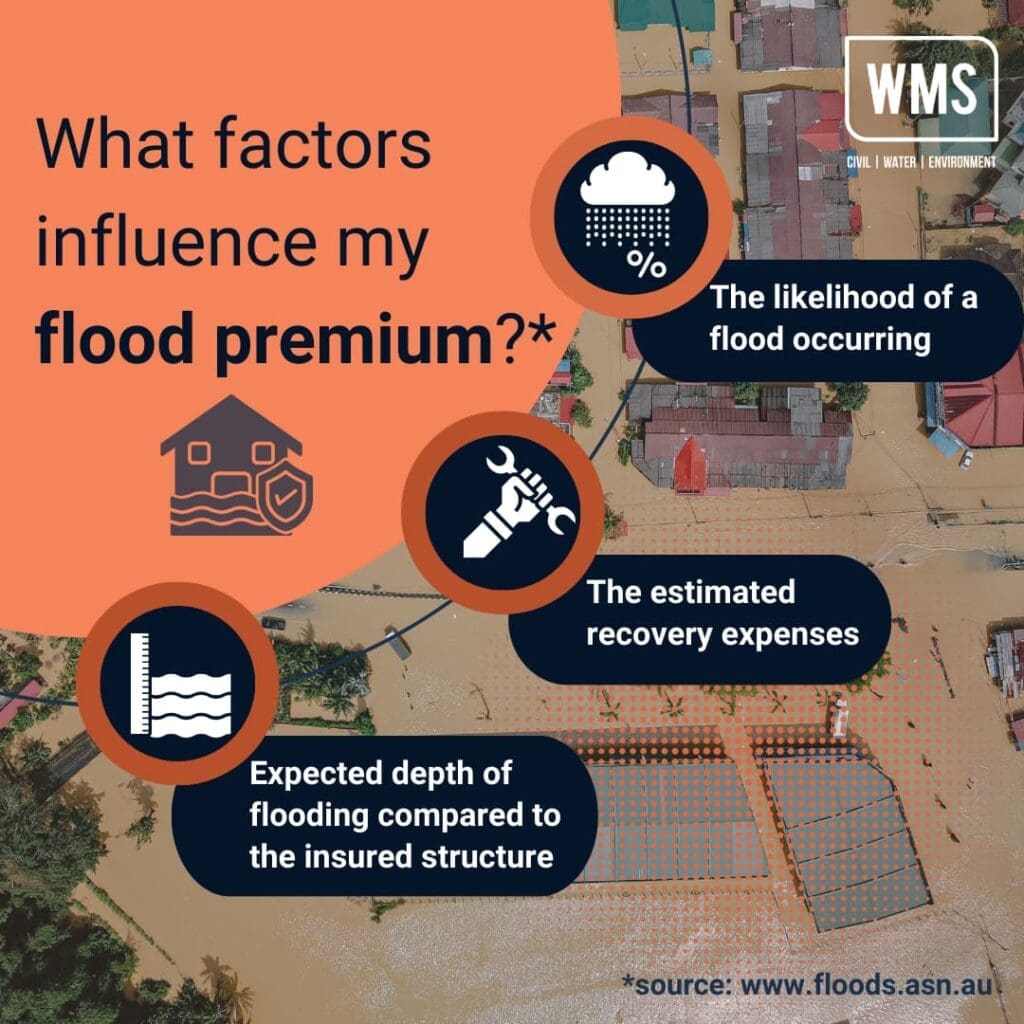

The big question: given the uncertainty of future climate events, how do insurance companies put a price on risk? In a broad sense, here are the top three factors insurers take into account:

And remember; insurance looks at the long game. They’re guarding against those one-off catastrophic floods that, while rare, can devastate properties. The chances may seem tiny, but the potential repair costs can be astronomical.

Where do insurers get their data?

In collaboration with state and territory governments, the general insurance sector has established the National Flood Information Database (NFID). This database comprises 11.3 million addresses paired with their respective flood risks, based on government flood maps. Insurers then take this data and any other official studies available and sometimes conduct in-house research. That said, each company evaluates risk a little differently.

What happens after I make a claim?

Let’s imagine disaster has struck and you need to make a claim. Regardless of the insurer you’ve settled on, the official process to claim involves a few mandatory steps.

If you have opted in for flood cover, and have been affected by flooding, the most likely outcome is that it will be paid out directly.

If you have not purchased flood cover (or a flood occurred within the exclusion period after you purchased it), insurers will undertake some investigation to determine if the claim should be paid out or not. The main thing they’re looking for is to work out if your damage was caused by a ‘flood’ or by ‘stormwater’ – sometimes the difference is obvious, but if, as we saw in 2022, a severe storm happens around the same time as a river overtops, some extra investigation might be needed.

Firstly, the insurer will need to appoint a hydrologist to carry out an onsite assessment of the property and damage. The hydrologist will then contact you to arrange a visit to your property, take photos of the damage for evidence and work out the timing and sequence of events, which will all go into an Insurance Hydrologist Report. The purpose is to ascertain the cause of damage (i.e. flooding or stormwater), and the proportion of damage attributable to flooding and/or stormwater. This is a service we offer at WMS, and helps inform the outcome of your claim.

Our hydrologist will then report back to the loss adjuster/insurer with these findings so that they can confirm the cause of damage and see if you’re insured for it. There are multiple levels of insurance and so the outcome might be that you are partially or entirely insured. Either way, it’s a process that our specialists aim to deliver with speed, accuracy and according to best practice.

Help! I think they’ve got it wrong?

Your insurer has gotten back to you with a flood premium that seems – all things considered – far too high. Is there anything you can do?

Fortunately, you have a few options. Firstly, you don’t have to settle for the first company you find. Shop around for your insurance, understand the coverage, and take all inclusions into account (don’t just focus on the dollar sign). Some handy tools endorsed by Floodplain Management Australia are Find An Insurer and Understand Insurance.

If you want to challenge their decision you can ask the insurer how the risk was calculated. They’re unlikely to share all their data and flood maps with you (as it’s sensitive information), so if you really want to make an appeal you’ll have to support it with your own evidence. Check your council mapping to find more information on your area’s flood risk, or enlist experts like engineers and hydrologists (aka. WMS!) to give you advice.

Another option to lower your insurance costs is to look into proactive measures. By making changes such as elevating your utilities and installing floor openings, you can protect your property from damage in the first place, and reduce your insurance premiums to boot if you inform your insurer about the steps you have taken to protect your property. Less risk equals happier insurers!

Given the uncertainties of future climate changes, protective measures like flood insurance are crucial for ensuring long-term prosperity. Whether or not you choose to invest in flood insurance will depend on your specific circumstances. However, with the right information, we hope you’ll feel empowered to explore your options and safeguard your property.